Aug 14, 2020

About Gold

Lori Gann Morris, CIMA®, AIF®, CeFT®, Co-Founder / Managing Partner

There are generally three “reasons” given when an investor wishes to buy gold: 1) It’s a hedge against inflation, 2) It’s a hedge against chaos, 3) It’s a play on a weaker dollar. A few thoughts on the validity of each….

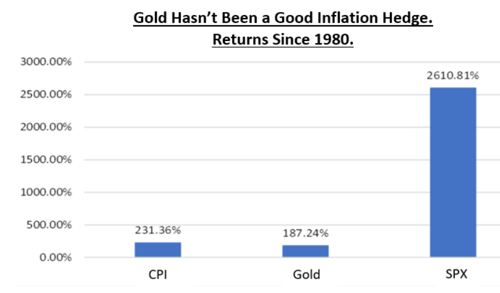

Invalid Reason to Consider Gold Now: Inflation Hedge

Gold has not been a good inflation hedge. To illustrate this point here’s a chart of the Consumer Price Index (CPI), Gold, and the S&P 500 returns since 1980. Our official measure of inflation (CPI) has risen 231% since 1980. The S&P 500 has gained an astounding 2,600%. Gold is up 187%, underperforming both statistical inflation, and the S&P 500. Stocks (or real estate) have been better alternatives as an inflation hedge.

Invalid Reason to Consider Gold Now: Chaos Hedge

Another reason we hear investors buying gold is a hedge against uncertainty. We understand that feeling of safety that gold provides. However, the 2020 rally in gold is not due to coronavirus or U.S./China geopolitical tensions. Instead, it can be attributed to the falling dollar. More broadly, buying and storing physical gold is inefficient and the transaction costs can be exorbitant. Additionally, the likelihood that society breaks down to the point where we need gold bars to pay for goods & services is very, very unlikely.

Valid Reason to Consider Gold Now: Falling Dollar

We all know that gold is a nice portfolio diversifier over the longer term, but that’s not the spirit in which many investors are buying gold today. Instead, they are buying it for profit (i.e. they think the spot price will keep going up). If that’s the objective, then the first question an investor should ask is whether they think the dollar will keep falling, because if the answer isn’t “yes” then gains in gold are likely to be generally underwhelming, and you will take on a lot of volatility for those gains.

Bottom Line

Talk of gold as a part of an investment portfolio is commonplace during times of political and economic uncertainty. However, it’s important to keep long-term goals in mind and make efforts to “tune out the noise”. Historically, stocks broadly outperform gold as an inflation hedge. Buying gold as a way to book short term profits does have merit, but this is a trading strategy and you would need to be supremely confident of further declines in the dollar. For the vast majority of investors with a goals-based financial plan, holding gold is not worth the additional risk and potential for long-term underperformance, when compared to equities.

Disclosures

All Investment Advisory Services are provided by Waterloo Capital d/b/a AMG Wealth Advisors, an SEC Registered Investment Adviser. Registration with the SEC does not imply a certain level of skill or expertise. AMG Wealth Advisors is not affiliated with Waterloo Capital. Additional information about Waterloo Capital d/b/a AMG Wealth Advisors, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov. Waterloo Capital does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal any historical performance level. Hyperlinks are provided as a courtesy and should not be deemed as an endorsement. When you link to a third-party website you are leaving our site and assume total responsibility for your use or activity on the third-party sites.